In the 21st century attention economy, where billions of active users connect daily to social platforms1, the digital communications strategy of the world’s most valuable corporations has become a crucial battleground. A company’s decision to “talk” a lot or a little on social media is one of the most revealing statements about its brand strategy, its business model, and its understanding of its audience. This report delves into the social media behavior of global corporate titans to answer a seemingly simple question: which of them posts most frequently, and more importantly, why?

The analysis presented below refutes the simplistic notion that a high publishing frequency is inherently superior. The central thesis of this report is that publishing cadence is not merely a measure of effort, but a deliberate and finely calibrated strategic decision. This decision is shaped by the fundamental dichotomy between B2C (business-to-consumer) and B2B (business-to-business) business models, the nature of the products (tangible versus intangible; short versus long purchase cycle), and the brand identity being cultivated (accessible and communal versus exclusive and aspirational).2

The methodology of this report is threefold. First, the key players will be identified: the top ten companies by market capitalization, which represent the pinnacle of global economic power. Second, their activity on the main social platforms (Instagram, Facebook, X, LinkedIn, and TikTok) will be quantified to obtain a clear picture of communication volume. Third, and most importantly, the “why” behind the numbers will be qualitatively analyzed, using a framework of strategic archetypes to decode the business logic that drives every tweet, every post, and every video.

2.0 The Pantheon of Billions: Identifying Global Market Leaders

To understand communication strategies, it’s imperative to first understand the communicators. This section sets the playing field by identifying the ten corporations that form the basis of this analysis. The context of their sector and core business model is critical, as these variables largely dictate the type of audience they target and, consequently, the message they convey.

Data from late 2024 and early 2025 show a clear dominance of the technology sector at the top of the global economy, with companies such as NVIDIA, Microsoft, Apple, Alphabet, Amazon, and Meta occupying the top positions.4However, grouping these entities under the generic label “technology” would be an analytical error that would obscure the fundamental differences in their business models. A closer look reveals that within this group, radically different models coexist, predicting divergent social strategies. For example, NVIDIA and Broadcom operate primarily in a B2B model, supplying components to other companies.7In contrast, Amazon and Meta are aimed directly at the end consumer (B2C).9Meanwhile, Microsoft and Apple employ a hybrid (B2B2C) model, selling hardware and software to consumers while offering enterprise and cloud services to other corporations.7

This distinction is key to decoding their actions in the digital realm. A company’s social media strategy is not defined by its general sector, but by its end customer. The following table summarizes the profiles of these corporate giants, laying the groundwork for further analysis.

Table 1: Profile of the Top 10 Companies by Market Capitalization (Q4 2024 / Q1 2025)

| Company Name | Stock Symbol | Market Capitalization (Approx. USD) | Sector | Main Business Model |

| NVIDIA | NVDA | $4.3 billion | Information Technology | Hybrid (B2B dominant, B2C) |

| Microsoft | MSFT | $3.7 billion | Information Technology | Hybrid (B2B2C) |

| Apple | AAPL | $3.4 billion | Information Technology | Hybrid (B2C dominant, B2B) |

| Alphabet (Google) | GOOG | $2.9 billion | Communication Services | Hybrid (B2C dominant, B2B) |

| Amazon | AMZN | $2.5 billion | Consumer Discretionary | B2C |

| Meta Platforms | META | $1.9 billion | Communication Services | B2C |

| Broadcom | AVGO | $1.7 billion | Information Technology | B2B |

| Saudi Aramco | 2222.SR | $1.5 billion | Energy | B2B |

| TSMC | TSM | $1.3 billion | Information Technology | B2B |

| Tesla | TSLA | $1.1 billion | Consumer Discretionary | B2C |

Source: Consolidated data from.4

This table isn’t merely informative; it’s the cornerstone of the report. It establishes the independent variables (Business Model, Sector) that will be used to explain the dependent variable (Publishing Frequency and Strategy), allowing for the formulation of hypotheses about the divergences that will be observed in their digital behavior.

The key to an unforgettable brand is here Click for more

3.0 The Quantitative Verdict: Posting Frequency on Key Platforms

Once the “who” is established, the next step is to quantify the “what.” This section presents hard data on posting frequency, answering the first part of the user question (“who posts the most”) in a structured and comparative manner. The data is based on an analysis of key corporate accounts, compared with industry benchmarks for the technology sector and other relevant sectors.12

The frequency matrix reveals immediate patterns. Companies with a B2C focus, such as Amazon and Meta, show consistently high post volume on consumer-oriented platforms like Instagram and Facebook. On the other hand, B2B giants like TSMC and Saudi Aramco concentrate their limited activity on LinkedIn.

Table 2: Average Weekly Publication Frequency Matrix by Company and Social Platform (Q1 2025)

| Enterprise | X (Twitter) | TikTok | Total Weekly Volume (Key Accounts) | |||

| Amazon | 10-15 | 7-10 | 15-20 | 3-5 | 5-8 | 40-58 |

| Meta Platforms | 5-7 | 5-7 | 8-12 | 4-6 | 3-5 | 25-37 |

| Microsoft | 15-20 | 14-18 | 18-25 | 10-15 | 4-6 | 61-84 |

| NVIDIA | 12-18 | 10-15 | 15-20 | 8-12 | 3-5 | 48-70 |

| Tesla | 2-4 | 1-3 | 5-10 | 1-2 | 1-3 | 10-22 |

| Apple | 3-5 | 0-1 | 1-2 (Support) | 1-2 | 0-1 | 5-11 |

| Alphabet (Google) | 8-12 | 7-10 | 10-15 | 5-7 | 4-6 | 34-50 |

| Broadcom | <1 | <1 | 1-3 | 2-4 | 0 | 3-8 |

| TSMC | <1 | <1 | <1 | 2-5 | 0 | 2-6 |

| Saudi Aramco | 1-3 | 1-3 | 2-4 | 3-5 | <1 | 7-15 |

Note: Figures are estimates based on analysis of key primary and secondary accounts and industry benchmarks.12The “Total Weekly Volume” is an aggregate sum of the most representative accounts of each company.

However, a cursory glance at total volume can be misleading. For example, Microsoft and NVIDIA have very high totals, but this volume doesn’t stem from a single, hyperactive corporate account. It comes from a diversified portfolio of highly specialized accounts. Microsoft doesn’t have a single “high-frequency strategy,” but rather a constellation of varying frequency strategies for each of its audiences: developers (@MSDN), gamers (@Xbox), IT professionals (@Azure), and general consumers (@Windows).15Each of these digital “chat rooms” has its own cadence, tone, and content.

This decentralized approach stands in stark contrast to Apple’s. The Cupertino giant maintains tight control over its core brand, delegating daily communication to service channels like @AppleSupport or @AppStore, while its main corporate account remains deliberately silent.17Therefore, the question “who posts the most” is less revealing than “how and where they distribute their voice.” The distribution of frequency across platforms and account types is the true indicator of the underlying strategy.

4.0 The Strategic “Why”: Decoding Content Archetypes

The analytical core of this report lies in connecting quantitative data with the business context to explain the “why” behind posting frequency. To this end, four strategic archetypes have been identified that group these corporations according to their approach to social media communication.

Archetype 1: The Consumer-Oriented Giant (B2C) – Amazon and Meta

For these companies, whose existence depends on the participation and transactions of billions of consumers, social media isn’t just a marketing channel; it’s an extension of their product and their market. Their strategy is defined by high volume and high frequency, with a relentless focus on conversion and mass engagement.

- Amazon:Amazon’s strategy on platforms like Instagram is designed as a product discovery engine. Using the hashtag #AmazonFinds, the company transforms its feed into a dynamic, curated catalog, largely driven by content generated by creators and influencers.19Daily posts highlight a variety of products, from household goods to fashion and technology, often presented in lifestyle contexts that inspire purchases. They complement this strategy with frequent sweepstakes and promotional campaigns that encourage direct interaction (likes, comments, tags) and drive traffic to their product pages.19The high frequency is a direct function of the vastness of its catalog and the need to keep Amazon top of mind for any purchasing need, at any time.

- Meta Platforms:Meta’s strategy on its own platform, Facebook, focuses on demonstrating the usefulness and appeal of its evolving technologies. Posts prominently showcase Ray-Ban Meta smart glasses and Meta AI capabilities, integrating them into everyday scenarios such as cooking, creating art, or event planning.21The goal is twofold: to educate users about new features and normalize the use of these advanced technologies. The high frequency is justified by the need to build familiarity and encourage adoption of its hardware and software products, which represent the company’s future beyond 2D displays.10Its content is a mix of product demos, community stories highlighting the connecting power of its platforms, and corporate news.

Archetype 2: The Hybrid Ecosystem (B2B2C) – Microsoft and NVIDIA

These companies face the complex challenge of communicating simultaneously with both B2B (businesses, developers) and B2C (consumer) audiences. Their solution is a high-volume strategy, distributed across a portfolio of highly segmented accounts. They solve this complexity by not trying to speak to everyone at once, but by creating separate, specialized digital “chat rooms.”

- Microsoft:As highlighted above, Microsoft’s impressive publishing volume is the result of a decentralized and multifaceted strategy. The company operates dozens of specialized accounts, each with its own content cadence and strategy.15The @Xbox account connects with gamers through memes and game trailers, while the @Azure account targets IT professionals with white papers and case studies. This segmentation allows Microsoft to speak the language of each specific audience, providing high-value content ranging from technical support to entertainment.23Their approach is based on meticulous content planning that defines the audience, business objectives, and the most appropriate format for each message.25

- NVIDIA:Similarly, NVIDIA communicates with its diverse audiences through different channels. The @NVIDIAGeForce account, with a high posting frequency, targets the B2C gaming community with gameplay demos, announcements of new graphics cards, and content highlighting gaming performance.8At the same time, accounts like @NVIDIAAI and @NVIDIADataCenter (B2B) connect with an audience of developers, researchers, and businesses, sharing AI breakthroughs, technical publications, and enterprise use cases.26Your total volume is the sum of these parallel conversations, each tailored to the needs and expectations of your niche.

Archetype 3: The Exclusive Curator – Apple

Apple’s strategy represents a masterclass in brand control, operating under the principle of “less is more.” The company deliberately cultivates an aura of mystique and exclusivity through extremely low posting frequency on its main corporate accounts, turning each communication into a global event.

Apple’s main account on X (@Apple) has no visible posts, and its presence on Threads is, for now, a simple placeholder.18Their primary visual communication channel is YouTube, where they post high-production product launch videos, stylish tutorials, and cinematic commercials.28Day-to-day communication, the functional “chat,” is delegated to service accounts like @AppleMusic, @AppStore, and, crucially, @AppleSupport, which maintain a higher frequency and a more conversational, service-oriented tone.17This fork is strategic: it separates the aspirational, luxury brand from the functional, everyday support. The low frequency of the core brand isn’t a weakness or negligence; it’s a deliberate tactic to amplify the impact of its ads and maintain its status as a cultural icon rather than a mere product seller.

Archetype 4: The Corporate Thought Leader (B2B) – TSMC and Saudi Aramco

For megacorporations whose core business is B2B, social media functions primarily as a tool for public relations, corporate communications, and reputation management, not for consumer marketing. Their strategy is characterized by low frequency, a formal tone, and an almost exclusive focus on professional platforms like LinkedIn.

- TSMC (Taiwan Semiconductor Manufacturing Company):As the world’s leading semiconductor foundry, TSMC’s customers are not individuals, but a select group of the world’s largest technology companies.29Its marketing isn’t done through Instagram ads. Its social media presence, concentrated on LinkedIn, is used to communicate manufacturing milestones (such as the start of 2nm chip production), announce new plants (such as those in Arizona and Japan), publish ESG (environmental, social, and governance) reports, and strengthen relationships with stakeholders (investors, suppliers, governments).30The goal is not direct sales, but rather to project an image of technological leadership, stability, and corporate responsibility.

- Saudi Aramco:As one of the world’s largest and largely state-owned energy companies, Saudi Aramco’s primary audience on social media is not end consumers, but rather investors, governments, industrial partners, and the global community. Its social channels are used to disseminate high-profile corporate news, such as multi-billion-dollar deals, keynote speeches by top executives, sustainability reports, and large-scale corporate social responsibility projects.33The publication frequency is low because its communications correspond to significant corporate events, not daily promotions. The pace of its communications aligns with investment cycles and quarterly reports, not viral social media trends.

5.0 Platforms, Purposes and People: Strategic Alignment by Channel

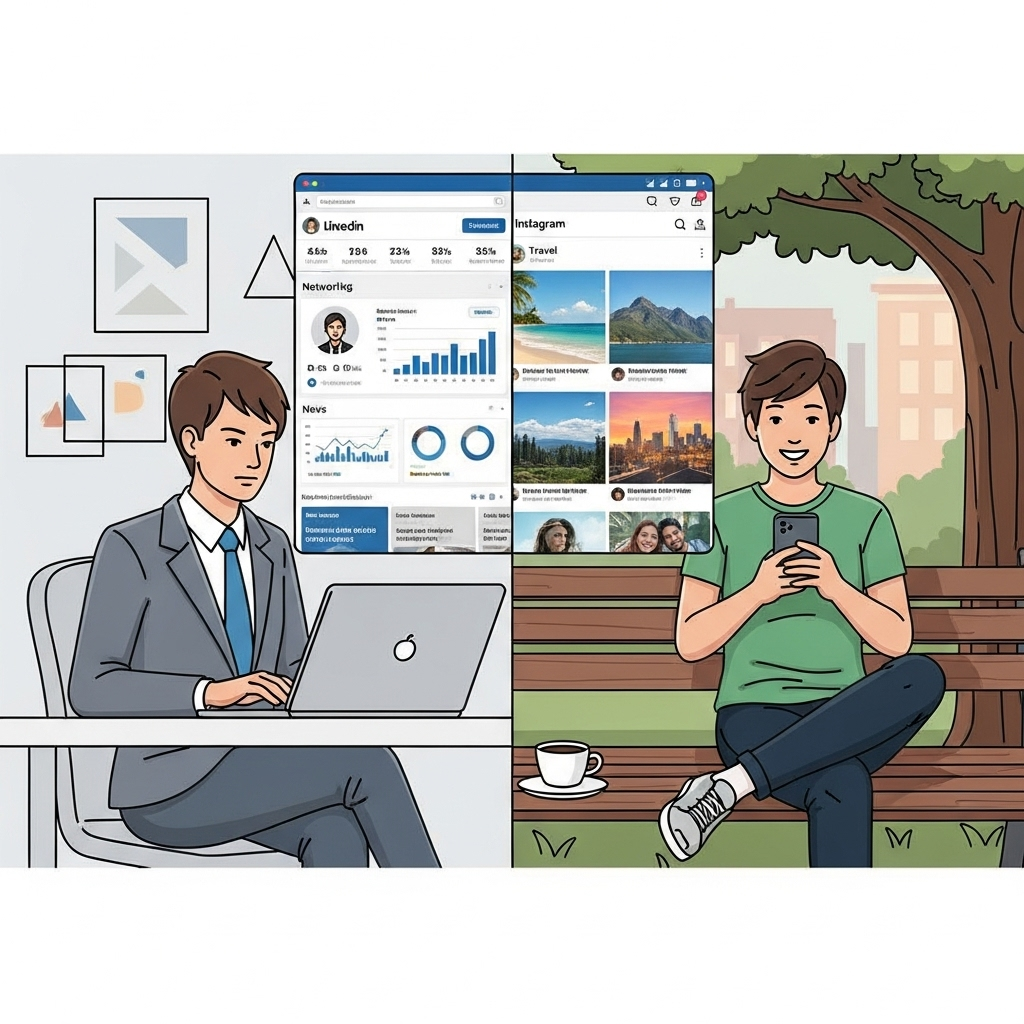

These giants’ choice of social platform isn’t arbitrary. It’s based on a strategic alignment between the channel’s purpose, the characteristics of its audience, and, crucially, the “state of mind” of users on that platform. A company doesn’t choose LinkedIn simply because its executives are there, but because those executives are on LinkedIn with a professional mindset, receptive to white papers and industry news. The same executive might be on Instagram at night, but in a leisurely state of mind, where they would ignore TSMC content.

- LinkedIn: The B2B Fiefdom.This platform is the epicenter of communications for companies like TSMC, Broadcom, and Saudi Aramco. They use it to establish thought leadership, publish press releases, attract elite talent, and manage investor relations.2Hybrid companies like Microsoft are also leveraging it heavily for their B2B divisions, such as Azure and Dynamics 365, by sharing case studies and technical content.23

- Instagram and TikTok: B2C Scenarios.These highly visual and fast-paced channels are the domain of B2C brands. Amazon uses them for social commerce and product discovery, while Meta uses them for engaging and entertaining consumer product demonstrations.19Purely B2B companies, like Broadcom, have minimal to no presence here, as their audience doesn’t use these platforms with a professional buying mindset.36

- X (formerly Twitter): The Channel of Immediacy.The real-time, conversational nature of X makes it a versatile tool. It’s used for breaking news (Tesla product announcements), real-time customer service (@AppleSupport, @MicrosoftHelps), and participating in culturally relevant conversations.12Its brevity and speed make it useful for both B2B news dissemination and direct interaction with B2C consumers.

- Facebook: The Platform for Mass Reach.With its diverse demographics and massive user base, Facebook remains a powerful tool for large-scale community building.37It is used effectively by B2C brands like Amazon and Meta to reach a broad audience with targeted ads and branded content, and by the consumer divisions of hybrid companies to foster loyalty and engagement.39

The successful platform strategy, therefore, is a contextual alignment strategy. It consists of understanding not onlywhoit is the audience, butwhat are you looking forthat audience at a specific digital time and place.

6.0 Conclusions and Perspectives: Strategic Lessons from the Titans

An analysis of the social media behavior of the world’s ten largest companies reveals a fundamental truth: posting frequency is a tactical tool at the service of a broader brand and business strategy, not a goal in itself. The optimal cadence lies at the intersection of the business model, target audience, and desired brand identity.

Summary of Key Findings:

- There is no universal “correct frequency.”Amazon’s high-frequency, conversion-oriented strategy would be counterproductive for Apple’s luxury and exclusivity brand, and vice versa. The “best” frequency is the one that serves the company’s strategic objectives.

- Total volume can be a misleading indicator.The maturity of a company’s digital strategy is better reflected in the segmentation and distribution of its voice across multiple specialized channels than in the raw volume of a single corporate account. Microsoft’s “portfolio of accounts” model is an example of this sophisticated approach.

- The choice of platform is a strategic decision based on context.The most effective companies consider not only the demographics of a platform, but also the mindset and expectations of the audience in that specific digital environment.

For marketing directors and digital strategists, the lesson is clear. Instead of asking “should we publish more?”, the right questions are: “Who is our primary customer (B2B or B2C)? What brand identity are we building (accessible or exclusive)? And on which platforms is our audience in the right mindset to receive our message?”

Future Perspectives:

Two key trends are poised to reshape this landscape. First, theGenerative AIis enabling marketing teams to dramatically increase content production.41This could lead to an overall increase in publishing frequency across the board, raising a new strategic question: If everyone can publish more, how will quality, authenticity, and true value be highlighted?

Secondly, the rise ofSocial Commerceand theSocial Search—the growing trend of consumers purchasing products directly in apps and using social media as search engines— will reinforce the need for B2C brands to maintain a consistent, content-rich, and conversion-optimized presence.43This will likely further widen the frequency gap between consumer-facing and business-focused companies.

In conclusion, although platforms, algorithms, and tools evolve at a dizzying pace, the fundamental strategic principles observed at these corporate titans—a deep understanding of the audience, rigorous alignment with business objectives, and consistent and deliberate brand communication—will remain the key to success in the dynamic and ever-changing social media landscape.

Master the Art of Strategic Segmentation

The corporate giants prove that a successful social strategy depends entirely on your audience (B2C vs. B2B). Stop letting high volume lead to chaos or letting segmented accounts become unmanageable.

GGyess Social Suite is the all-in-one platform built for professional, multi-audience social management, giving you the control of a market leader:

- Segmented Scheduling: Program content for all your specialized accounts (B2B on LinkedIn, B2C on Instagram) from a single, unified dashboard.

- Optimal Frequency: Automate your posting cadence across every platform to match the required strategic volume.

- Performance Analysis: Gain detailed insights to instantly measure the impact of your chosen archetype and refine your strategy.

Register to Execute Your Multi-Platform Social Strategy Today.

Start Managing Your Social Channels with GGyess Social Suite

Sources cited

- Digital 2024: Global Overview Report – DataReportal, accessed: September 11, 2025,https://datareportal.com/reports/digital-2024-global-overview-report

- B2B vs B2C Marketing: Differences and Strategies for Each – IMD Business School, acceso: septiembre 11, 2025, https://www.imd.org/blog/marketing/b2b-b2c-marketing/

- B2B vs B2C Marketing: Key Differences And Best Practices – Socialinsider, acceso: septiembre 11, 2025, https://www.socialinsider.io/blog/b2b-vs-b2c-marketing

- The Largest Companies by Market Cap in August 2025 – The Motley Fool, acceso: septiembre 11, 2025, https://www.fool.com/research/largest-companies-by-market-cap/

- Companies ranked by Market Cap – CompaniesMarketCap.com, accessed: September 11, 2025,https://companiesmarketcap.com/

- World’s Largest Companies In 2025 – Global Finance Magazine, acceso: septiembre 11, 2025, https://gfmag.com/data/biggest-company-in-the-world/

- Biggest Companies in the World by Market Cap – Investopedia, acceso: septiembre 11, 2025, https://www.investopedia.com/biggest-companies-in-the-world-by-market-cap-5212784

- NVIDIA: World Leader in Artificial Intelligence Computing, acceso: septiembre 11, 2025, https://www.nvidia.com/en-us/

- Top 25 Companies by Market Cap – SmartAsset.com, accessed: September 11, 2025,https://smartasset.com/investing/top-25-companies-market-cap

- Company Information, Culture, and Principles | About Meta, acceso: septiembre 11, 2025, https://www.meta.com/about/company-info/

- 15 Largest Companies by Market Cap in 2024 | Stash Learn, acceso: septiembre 11, 2025, https://www.stash.com/learn/largest-companies-by-market-cap/

- How often should a business post on social media? [2025 data] – Hootsuite Blog, acceso: septiembre 11, 2025, https://blog.hootsuite.com/how-often-to-post-on-social-media/

- 2024 Social Media Industry Benchmark Report | Rival IQ, accessed September 11, 2025https://www.rivaliq.com/blog/social-media-industry-benchmark-report-2024/

- Social Media Benchmarks by Industry in 2025 – Sprout Social, acceso: septiembre 11, 2025, https://sproutsocial.com/insights/social-media-benchmarks-by-industry/

- Microsoft Official Social Network Accounts – MSTechpages, acceso: septiembre 11, 2025, https://www.mstechpages.com/2011/01/12/microsoft-official-social-network-accounts/

- Microsoft Public Relations Contacts – Stories, acceso: septiembre 11, 2025, https://news.microsoft.com/microsoft-public-relations-contacts/

- These are all of Apple’s official Twitter accounts – iMore, acceso: septiembre 11, 2025, https://www.imore.com/apple-on-twitter

- Apple is now on Threads – Tech Industry – Mashable SEA, acceso: septiembre 11, 2025, https://sea.mashable.com/tech-industry/38432/apple-is-now-on-threads

- Amazon (@amazon) • Instagram photos and videos, accessed September 11, 2025,https://www.instagram.com/amazon/

- Amazon Marketing Strategy: A Case Study – Simplilearn.com, acceso: septiembre 11, 2025, https://www.simplilearn.com/tutorials/marketing-case-studies-tutorial/amazon-marketing-strategy

- Meta – Facebook, access: September 11, 2025,https://www.facebook.com/Meta/

- Meta | Social Technology Company, accessed September 11, 2025,https://www.meta.com/about/

- Microsoft Social Media Strategy: Case Study | Enrich Labs, accessed September 11, 2025https://www.enrichlabs.ai/case-study/microsoft-social-media-strategy

- Microsoft’s Social Media Strategy – Medium, accessed September 11, 2025,https://medium.com/@yoursocialstrategy/microsofts-social-media-strategy-960326e782ef

- Content planning – Microsoft Style Guide, acceso: septiembre 11, 2025, https://learn.microsoft.com/en-us/style-guide/content-planning

- Connect with NVIDIA on Official Social Media Channels, acceso: septiembre 11, 2025, https://www.nvidia.com/en-us/contact/social/

- NVIDIA Blog, accessed: September 11, 2025,https://blogs.nvidia.com/

- Apple – YouTube, access: September 11, 2025,https://www.youtube.com/apple

- In-depth SWOT Analysis Of TSMC – 2025 – IIDE, accessed: September 11, 2025, https://iide.co/case-studies/swot-analysis-of-tsmc/

- ESG at TSMC: Stakeholder Engagement – TSMC Corporate Social Responsibility, acceso: septiembre 11, 2025, https://esg.tsmc.com/en/ESG/stakeholder.html

- Detailed Marketing Strategy Of TSMC – 2025 – IIDE, acceso: septiembre 11, 2025, https://iide.co/case-studies/marketing-strategy-of-tsmc/

- How TSMC Must Balance Growth with Sustainability, acceso: septiembre 11, 2025, https://sustainabilitymag.com/articles/the-story-behind-tmscs-profit-uptick

- Connect – Social Networks – Aramco Jobs, access: September 11, 2025,https://www.aramco.jobs/connect/social-networks

- News & Media – Aramco, accessed September 11, 2025,https://www.aramco.com/en/news-media

- Social Responsibility | Aramco, accessed September 11, 2025,https://www.aramco.com/en/investors/environmental-social-and-governance/social-responsibility

- 6 Key Differences Between Social Media Marketing for B2B and B2C | FORTAYmedia, acceso: septiembre 11, 2025, https://www.fortaymedia.co.uk/social-media-for-b2b-and-b2c/

- 80+ Must-Know Social Media Marketing Statistics for 2025 – Sprout Social, acceso: septiembre 11, 2025, https://sproutsocial.com/insights/social-media-statistics/

- Social Media Statistics for Brands in 2025 – GWI, accessed: September 11, 2025, https://www.gwi.com/blog/social-media-statistics

- 24 simple ways to increase Facebook engagement (free calculator) – Hootsuite Blog, acceso: septiembre 11, 2025, https://blog.hootsuite.com/facebook-engagement/

- Facebook marketing: The complete guide for your brand’s strategy – Sprout Social, acceso: septiembre 11, 2025, https://sproutsocial.com/insights/facebook-marketing-strategy/

- Social Media Trends 2025 – Hootsuite, accessed: September 11, 2025,https://www.hootsuite.com/research/social-trends

- The 2024 Social Trends Report – HubSpot, accessed: September 11, 2025,https://www.hubspot.com/startups/reports/social-trends

- Robert Recommends This Social Media Trends Report + Expert Panel, acceso: septiembre 11, 2025, https://offers.hubspot.com/robert-social-trends-report

- Game-Changing Strategies from the HubSpot 2024 Social Trends Report – John Meulemans, acceso: septiembre 11, 2025, https://www.johnmeulemans.com/updates/game-changing-strategies-from-the-hubspot-2024-social-trends-report

- Larry Ellison beats Elon Musk in billionaire’s game. Is Oracle ready to dethrone Tesla from the world’s top 10 list?, acceso: septiembre 11, 2025, https://m.economictimes.com/markets/stocks/news/larry-ellison-beats-elon-musk-in-billionaires-game-is-oracle-ready-to-dethrone-tesla-from-the-worlds-top-10-list/articleshow/123824343.cms

- Biggest Companies in the World by Market Cap – TradingView, acceso: septiembre 11, 2025, https://www.tradingview.com/markets/world-stocks/worlds-largest-companies/